haven t filed state taxes in 5 years

Delinquent Return Refund Hold program DRRH. Youve not been to the dentist for five years.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

But if you filed your tax return 60 days after the due date or the.

. Ad You Can Still File 2019 2020 Tax Returns. After all the IRS may look as far back into your tax records as three. Havent Filed Taxes in 5 Years If You Are Due a Refund.

Free Federal 1799 State. I recommend you visit your local Taxpayer Assistance Center TAC. If your return wasnt filed by the due date including extensions of time to file.

Any California resident who consistently fails to file a federal income tax return can and eventually will be detected. Its too late to claim your refund for returns due more than three years ago. Ad No Money To Pay IRS Back Tax.

However you can still claim your refund for any returns. If you still havent filed heres how you can file your taxes for free and take advantage of the biggest tax changes for this year. This story is updated.

If you owed taxes for the years you havent filed the IRS has not forgotten. Lets start with the worst-case scenario. Ensuring businesses comply with their employment tax filing and payment requirements is another priority for the IRS.

As we have previously recommended if you havent filed taxes in a long time you should consider two paths. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. This story is updated frequently.

Get Your Life Back With Relief From IRS Levies Liens Penalties Garnishments More. After 60 days have passed with a return filed or payment. Ad Find Out Why Precision Tax Gets The Highest Customer Ratings For IRS Tax Help.

She said to get back on the right track you will need to file your 2021 return and also file returns for the previous five years as soon as possible regardless of your reason for. After May 17th you will lose the 2018 refund as the statute of limitations. For each return that is more.

The penalty charge will not exceed 25 of your total taxes owed. The main reasons to file are getting a refund of any income tax withheld and to provide income documentation for subsidized housing Medicaid meals on wheels etc. To get your W-2s call your payroll departments from your previous jobs and ask them to mail them to your current address.

Answer 1 of 4. Ad Find Out Why Precision Tax Gets The Highest Customer Ratings For IRS Tax Help. Get Your Act Together.

Get Your Life Back With Relief From IRS Levies Liens Penalties Garnishments More. This penalty is usually 5 of the unpaid taxes. What you need to do is rectify the.

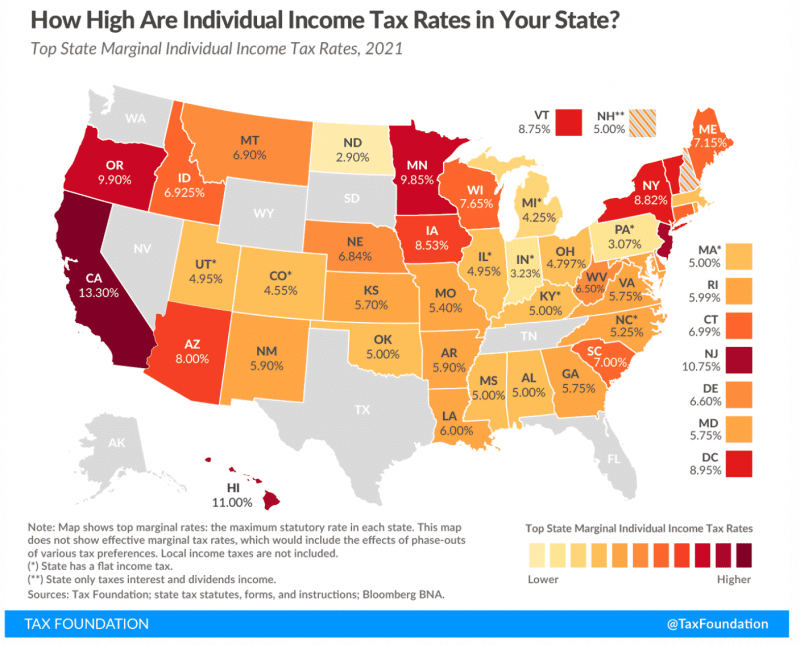

You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure. At the time of this writing the only states that do not charge a state income tax are Alaska Florida Nevada New Hampshire South Dakota Tennessee Texas. Go to IRSgov and get the last 3 years versions.

I assume the last federal return you filed was for tax year 2008 and you have not filed for 2009 - 2013. Weve filed over 50 Milllion Tax Returns with the IRS. Should you continue to not go because youre afraid of what the dentist may find.

Lets look at it a different way. It depends on your situation. There is a 25 maximum penalty that is reached should the amount due and return remain unfiled for five months.

Filing six years 2014 to 2019 to get into full compliance or four. The worst that could happen is that you could go to prison for tax evasion which can be as much as five years and 250000 in fines.

What If I Did Not File My State Taxes Turbotax Tax Tips Videos

12 Irs Non Stimulus Tax Rules You Ll Need This Year Tax Rules Irs Filing Taxes

Are You A Late Tax Filer Here S The Proscrastinator S Guide To Filing Income Taxes Filing Taxes Tax Day Income Tax

How To File Taxes Cashnetusa Blog Filing Taxes Tax Help Tax

How To File Taxes For Free In 2022 Money

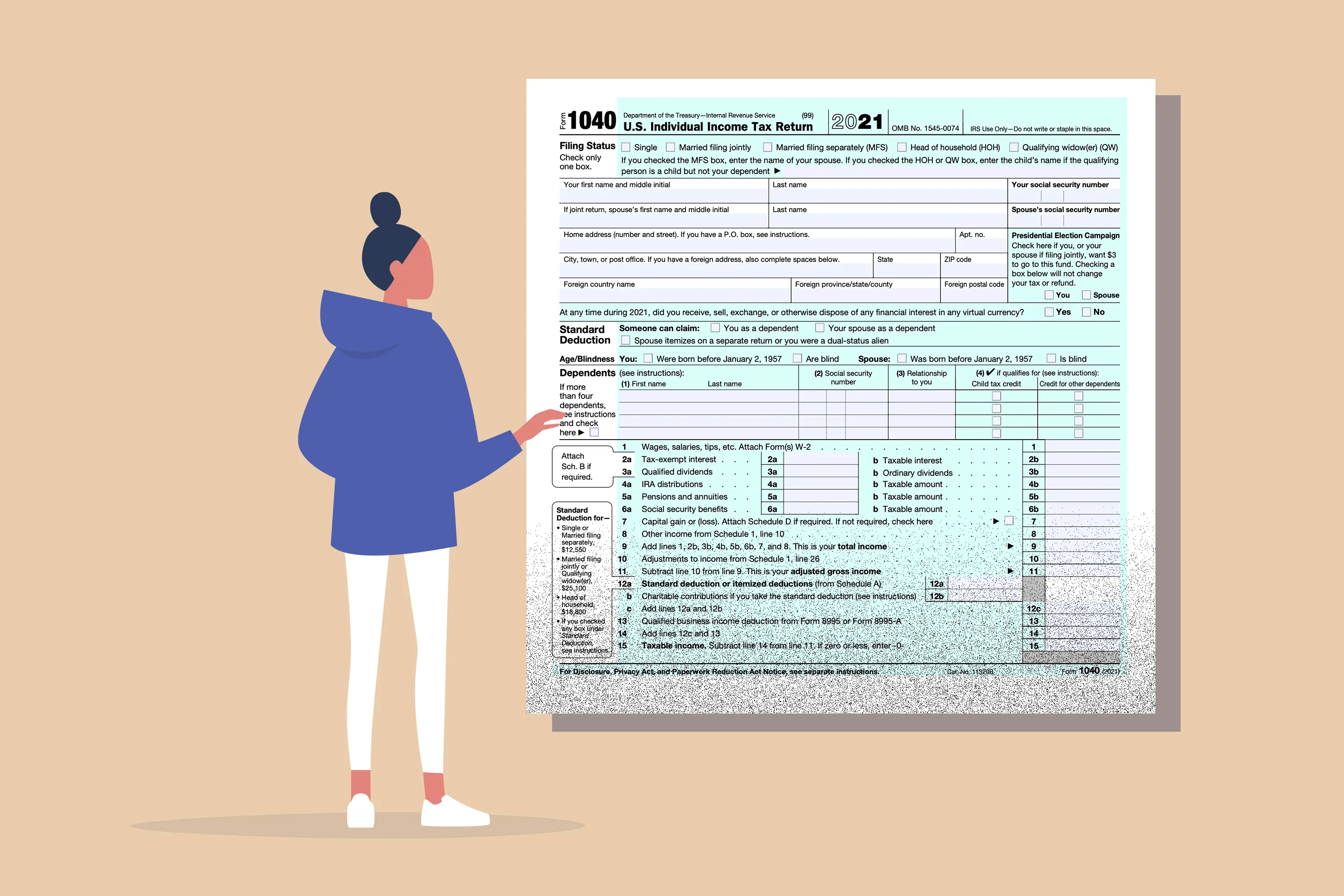

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

Find Out What To Do With A 1099 Form How To Include It With Your Personal Taxes And How To File This Type Of Income Tax Paying Taxes Income Income Tax Return

Where S My State Refund Track Your Refund In Every State Taxact Blog

Are You A Late Tax Filer Here S The Proscrastinator S Guide To Filing Income Taxes Filing Taxes Tax Day Income Tax

5 Income Tax Tips For Notaries And Signing Agents Nna Tax Deductions Income Tax Tax Day

How To File Previous Year Taxes Online Priortax Online Taxes Previous Year Tax

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

Iowans Here S Your 2021 And 2022 Iowa Income Tax Brackets And Planning Opportunities To Know About Arnold Mote Wealth Management

Taxes Payment Plans Irs Wesley Chapel Florida Mmfinancial Org Irs Taxes Payroll Taxes Irs

How Do State And Local Individual Income Taxes Work Tax Policy Center

Do I Have To File State Taxes H R Block

2020 Tax Deadline Is Today Here S What You Need To Know If You Haven T Filed Tax Deadline Tax Debt Health Savings Account

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)